The Sindh High Court (SHC) has dismissed a petition that sought to challenge the inclusion of municipal taxes in electricity bills in Karachi. This decision reaffirms the legality of the move by the Karachi Metropolitan Corporation (KMC) to levy municipal taxes through utility bills, a measure that has sparked widespread debate and opposition among the city’s residents and civil society groups.

The court’s ruling is significant as it upholds the government’s decision to integrate municipal tax collection into electricity bills, a mechanism that has been viewed by many as a convenient yet controversial method of ensuring tax compliance. The case has drawn attention to broader issues surrounding tax collection, governance, and the financial health of municipal bodies in Karachi, one of the largest and most densely populated cities in the world.

Background: The Introduction of Municipal Taxes in Electricity Bills

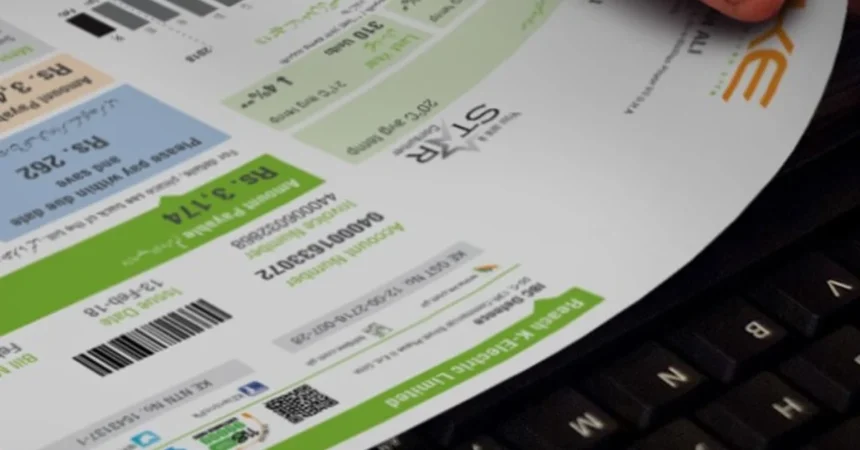

The KMC’s decision to include municipal taxes in electricity bills is part of a broader effort to enhance revenue collection for the city’s administration. The idea was first introduced in late 2021 as a way to increase the efficiency of tax collection and reduce the instances of tax evasion. The municipal taxes levied in the electricity bills, typically ranging from Rs. 50 to Rs. 200, were designed to help fund essential services such as waste management, road repairs, and public lighting.

Karachi, with its population of over 16 million people, faces numerous challenges related to urban development and infrastructure. The city’s strained financial resources have long been a topic of concern, with the municipal government frequently struggling to meet its obligations. The revenue collected through these taxes is intended to bridge this gap, providing the KMC with a more stable financial footing to carry out necessary public services.

However, the decision to incorporate these taxes into electricity bills was met with backlash from various quarters. Critics argued that the move unfairly burdened citizens, many of whom are already struggling with high utility costs. Consumer rights groups and activists expressed concerns about the transparency and accountability of how these funds would be used, raising fears of mismanagement and corruption. The matter eventually landed in court, as opponents sought legal recourse to halt the implementation of the policy.

The Legal Challenge and the Court’s Decision

The petition filed against the collection of municipal taxes through electricity bills was based on several key arguments. Firstly, the petitioners contended that the KMC did not have the legal authority to impose taxes through utility bills, as this fell outside the scope of its jurisdiction. They argued that municipal taxes should be collected through traditional means, such as property taxes, rather than being bundled with essential services like electricity, which are already a financial burden for many households.

The petition also raised concerns about the lack of public consultation and transparency in the decision-making process. Critics pointed out that residents were not adequately informed about the introduction of the municipal tax in their electricity bills and that there was no clear mechanism for them to challenge or opt out of these charges. This, they argued, violated their rights as consumers and taxpayers.

In response, the KMC and the Sindh government defended the move as both legal and necessary. They argued that the collection of municipal taxes through utility bills was a practical solution to the problem of low tax compliance, which had severely hampered the city’s ability to provide essential services. The respondents further stated that the revenue generated from these taxes was critical for maintaining and improving the city’s infrastructure, especially given the financial constraints faced by the KMC.

After hearing arguments from both sides, the Sindh High Court ruled in favor of the KMC, dismissing the petition. In its judgment, the court stated that the municipal government was within its rights to collect taxes through electricity bills, provided that the funds were used for the intended purposes of public service and infrastructure development. The court emphasized the importance of ensuring that municipal bodies have the necessary resources to carry out their functions and that the tax collection mechanism, while unconventional, was not illegal.

Public Reaction and Ongoing Debate

The court’s decision has sparked mixed reactions among Karachi’s residents and political commentators. For many citizens, the ruling comes as a disappointment, as they feel that they are being unfairly burdened with additional costs without receiving corresponding improvements in public services. Karachi’s infrastructure woes, including issues like uncollected garbage, poor road conditions, and frequent power outages, have long been a source of frustration for the city’s residents, and many are skeptical that the additional tax revenue will lead to tangible improvements.

Consumer rights groups have voiced their concerns about the ruling, arguing that it sets a troubling precedent for the bundling of unrelated charges into utility bills. They warn that this could pave the way for further taxes and fees to be added to essential services, making it even harder for low-income households to manage their expenses. Moreover, some critics fear that the lack of transparency in how the funds are used could lead to greater instances of corruption and mismanagement, particularly in a city where governance issues have been a persistent challenge.

On the other hand, supporters of the court’s decision, including officials within the KMC and Sindh government, argue that the municipal tax is a necessary step toward improving the city’s financial health. They contend that without such measures, the KMC would continue to struggle to provide basic services, ultimately harming the city’s residents in the long run. Proponents of the policy also point out that the amounts being charged are relatively modest and are intended to ensure that everyone contributes to the upkeep of the city’s infrastructure.

The Financial State of the KMC

The broader context of this issue lies in the financial struggles of the Karachi Metropolitan Corporation. For years, the KMC has faced significant budget shortfalls, with its revenue collection consistently falling short of its expenditure needs. This has resulted in a backlog of unpaid bills, delayed infrastructure projects, and a general decline in the quality of public services in Karachi.

One of the key reasons for the KMC’s financial woes is its low rate of tax collection. Property taxes, which are supposed to be a major source of revenue for the city, have historically been difficult to collect, with many residents either evading taxes or underreporting the value of their properties. Additionally, Karachi’s sprawling urban landscape and complex governance structure have made it challenging for the KMC to effectively manage its tax collection efforts.

In this context, the introduction of municipal taxes through electricity bills was seen as a way to boost revenue collection by leveraging the well-established utility payment system. By piggybacking on the existing infrastructure of the Karachi Electric (KE) company, the KMC could ensure that more residents contributed to the city’s upkeep, reducing the likelihood of tax evasion.

Transparency and Accountability Concerns

One of the key issues raised by opponents of the municipal tax policy is the question of transparency and accountability. Many residents are concerned that the additional revenue generated from these taxes will not be used effectively or transparently, particularly given the history of mismanagement within the KMC. Corruption and inefficiency have long plagued the city’s municipal administration, and there are fears that the funds collected through electricity bills could end up being misused or siphoned off for other purposes.

In response to these concerns, the KMC has pledged to improve its oversight mechanisms and ensure that the revenue from municipal taxes is used for its intended purposes. Officials have stated that the funds will be allocated specifically for services such as waste management, road repairs, and public lighting, with regular audits to ensure accountability. However, critics argue that more needs to be done to build public trust, including greater transparency in how the funds are allocated and spent.

Legal Implications and Future Challenges

The Sindh High Court’s ruling sets an important legal precedent for the collection of municipal taxes through utility bills. While the court has upheld the legality of the policy, the ruling is likely to spark further legal and political challenges in the future. Consumer rights groups and civil society organizations have already indicated that they may pursue further legal action to challenge the policy on other grounds, including concerns about consumer rights and the transparency of the tax collection process.

In addition to potential legal challenges, the KMC and the Sindh government will need to address the broader public concerns about the impact of the tax on low-income households. With inflation and the rising cost of living already putting pressure on many families, the additional burden of municipal taxes may lead to increased discontent and protests in the future.

Looking Ahead: The Future of Municipal Tax Collection in Karachi

The Sindh High Court’s decision marks a significant moment in the ongoing debate over municipal tax collection in Karachi. While the ruling provides legal validation for the KMC’s policy, the broader questions of fairness, transparency, and governance remain unresolved. As Karachi continues to grapple with its financial challenges, the success of the municipal tax policy will ultimately depend on the city’s ability to use the revenue effectively and to win the trust of its residents.

Moving forward, the KMC will need to demonstrate that the funds collected through electricity bills are being used for the intended purposes and that they are making a tangible difference in the quality of public services. Without visible improvements in areas such as waste management, road repairs, and public safety, the opposition to the tax is likely to persist, and the KMC could face further legal and political hurdles in the future.

The court’s decision, however, also opens the door for other municipalities across Pakistan to consider similar methods of tax collection. If the policy proves successful in Karachi, it could serve as a model for other cities facing similar challenges in revenue generation and infrastructure development.

#SindhHighCourt #KarachiTaxes #MunicipalTax #ElectricityBills #KarachiGovernance #KMC #UrbanDevelopment #TaxCollection #KarachiInfrastructure #ConsumerRights #LegalDecision #KarachiElectric #PublicServices