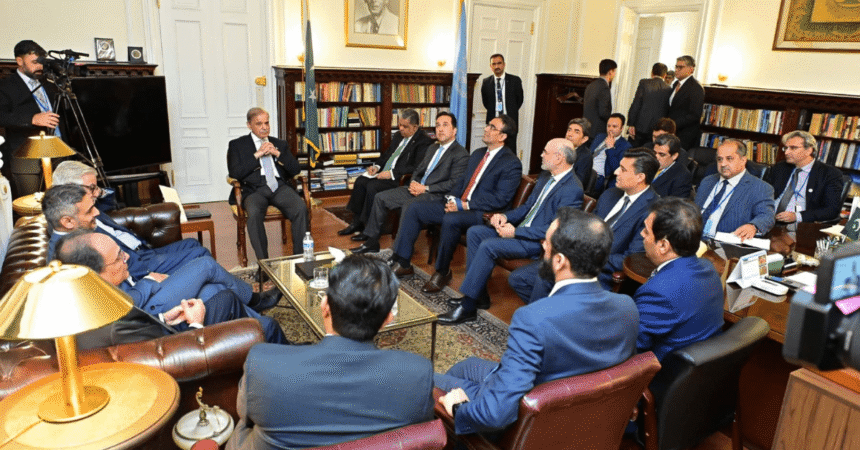

Prime Minister Shehbaz Sharif has made a significant overture to American financial institutions, inviting them to invest in Pakistan’s key sectors during his engagement with a delegation of prominent Pakistani-American bankers at the 79th United Nations General Assembly (UNGA) in New York. This initiative aims to tap into American capital, technology, and expertise to support Pakistan’s economic recovery and development.

Context of the Invitation

The backdrop to this invitation is critical. Pakistan has been grappling with economic challenges, including high inflation, a burgeoning fiscal deficit, and a mounting external debt. As the country seeks to stabilize its economy, foreign investment becomes crucial. Engaging with American banks—some of the world’s most influential financial institutions—could lead to substantial capital inflows and strategic partnerships that drive economic growth.

The Current Economic Landscape

Pakistan’s economic landscape has seen turbulent times over recent years, exacerbated by a combination of political instability, natural disasters, and global economic fluctuations. The COVID-19 pandemic further strained the economy, leading to job losses, increased poverty rates, and a contraction in key sectors. Consequently, the government has prioritized foreign direct investment (FDI) as a means to rejuvenate the economy.

crossorigin=”anonymous”>Recent Economic Reforms

During the meeting, PM Shehbaz Sharif detailed various initiatives undertaken by his government to stabilize the economy and create a conducive environment for foreign investment. Key reforms include:

- Broadening the Tax Base: The government has recognized that Pakistan’s narrow tax base is a significant hurdle to fiscal stability. Efforts are underway to enhance tax collection through reforms aimed at making the tax system more equitable and efficient. This includes digitalization efforts to improve transparency and reduce tax evasion.

- Improving Ease of Doing Business: The Prime Minister emphasized the government’s commitment to reducing bureaucratic hurdles that often deter investment. Simplifying processes, reducing regulatory red tape, and improving the overall business environment are critical components of this initiative.

- State-Owned Enterprises Reform: The restructuring of state-owned enterprises (SOEs) has been a contentious issue in Pakistan for years. The current government is focusing on operational improvements and privatization to reduce the fiscal burden of inefficient SOEs on the national budget.

- Sustainable Finance Framework: Recognizing the importance of sustainability, the government has established a framework to issue green and sustainability bonds in international capital markets. This initiative aims to attract environmentally-conscious investors and promote sustainable development in Pakistan.

Response from the Banking Delegation

The delegation, comprising high-ranking representatives from major banks such as JP Morgan, Goldman Sachs, and Lazard, expressed appreciation for the government’s efforts. They commended the policies that have led to improved macroeconomic stability. Their interest in cooperating with the Pakistani government is a positive signal that American banks are open to exploring opportunities in Pakistan.

Focus on the Manufacturing Sector

A noteworthy aspect of the discussions was the delegation’s keen interest in the development of the manufacturing sector, particularly focusing on Small and Medium Enterprises (SMEs). SMEs play a crucial role in economic development, as they account for a significant portion of employment and contribute to exports. By bolstering this sector, the government aims to diversify its economic base and reduce reliance on imports.

Strategic Sectors for Investment

The sectors highlighted for potential investment are vital for Pakistan’s economic growth and transformation:

1. Infrastructure Development

Infrastructure remains a pressing need in Pakistan. The country requires significant investment in transportation networks, logistics, and urban development to accommodate its growing population and urbanization. This includes:

- Road and Rail Networks: Upgrading and expanding road and rail networks is essential for improving connectivity and facilitating trade.

- Urban Development: As cities expand, there is a need for modern housing, sanitation, and public transport systems.

2. Energy Sector

Pakistan faces chronic energy shortages, which hinder economic growth and productivity. Investment in the energy sector is critical, particularly in:

- Renewable Energy: With abundant sunlight and wind resources, Pakistan has the potential to harness solar and wind energy. Investments in this area can not only alleviate energy shortages but also contribute to environmental sustainability.

- Energy Efficiency: Improving energy efficiency across industries can significantly reduce consumption and costs.

3. Technology and Innovation

The technology sector in Pakistan has seen remarkable growth, particularly in recent years, driven by a young population and increasing internet penetration. Key areas for investment include:

- Startups and Innovation Hubs: Fostering innovation through investment in tech startups can create jobs and boost economic growth.

- Digital Transformation: Enhancing digital infrastructure and services is essential for driving efficiency and competitiveness in various sectors.

4. Agriculture

Agriculture remains the backbone of Pakistan’s economy, employing a significant portion of the workforce. Investment in this sector can enhance productivity and food security. Focus areas include:

- Modern Agricultural Practices: Introducing advanced farming techniques and technologies can increase yields and sustainability.

- Agri-Tech Solutions: Investing in agri-tech can improve supply chain efficiency and access to markets for farmers.

Future Prospects and Challenges

The invitation to American banks opens up a realm of possibilities for Pakistan. However, the journey ahead is fraught with challenges that need to be navigated carefully.

1. Ensuring Macro-Economic Stability

Continued economic reforms and maintaining stability will be crucial. This includes managing inflation, ensuring fiscal discipline, and maintaining a stable currency to instill confidence among foreign investors.

2. Strengthening Governance and Transparency

A robust legal and regulatory framework is vital for attracting and retaining foreign investment. Ensuring transparency and efficiency in governance will help mitigate risks and build investor trust.

3. Infrastructure Development

To attract investment, Pakistan must prioritize infrastructure development. This includes not only physical infrastructure but also digital infrastructure to support modern business operations.

4. Fostering Partnerships

Building strong partnerships between American banks and local businesses will be essential for the successful implementation of investment projects. Collaborative approaches can enhance knowledge transfer and capacity building in various sectors.

5. Monitoring and Evaluation

Establishing mechanisms for monitoring and evaluating the impact of investments will be essential. This includes assessing economic, environmental, and social impacts to ensure that projects deliver tangible benefits to the economy and society.

Prime Minister Shehbaz Sharif’s invitation to American banks signifies a proactive approach to enhancing Pakistan’s economic landscape. By focusing on key sectors such as infrastructure, energy, technology, and agriculture, the government is not only seeking to attract foreign capital but is also laying the groundwork for sustainable economic growth.

As Pakistan strives to reposition itself as an attractive investment destination, the successful engagement with American banks could provide the necessary impetus to address the country’s economic challenges. The focus on reforms, stability, and collaboration will be critical to harnessing the potential of foreign investment and improving the livelihoods of its citizens.

Ultimately, the path forward will require a strategic, coordinated approach that ensures the benefits of investment are felt across all sectors of society. Through sustained efforts and effective partnerships, Pakistan can unlock its economic potential and achieve a more prosperous future.