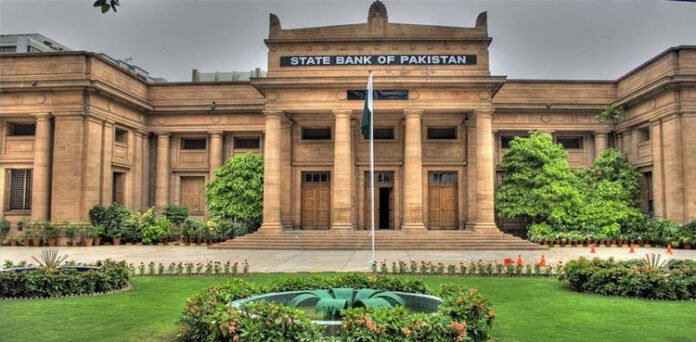

ISLAMABAD:Pakistan’s central bank purchased a record over $9 billion from the local market in the past year to stabilise foreign exchange reservesa staggering amount that has helped the country remain afloat despite low inflows of foreign loans.

During the calendar year 2024, the central bank purchased over $9 billion, said Jameel Ahmad, Governor of the State Bank of Pakistan, while speaking to The Express Tribune after a meeting of the Senate Standing Committee on Finance. Of the $9 billion, over $4.5 billion was bought between July and December 2024, said the governor.

Ahmad further stated that Pakistan has also requested the United Arab Emirates (UAE) to roll over $2 billion in cash deposit debt, maturing between January 17 and 21. He added that the UAE has already committed to the International Monetary Fund (IMF) to roll over the loans as part of the Extended Fund Facility deal.

In return for 40 strict conditions, the IMF provided a $7 billion loan package to Pakistan, with disbursements linked to biannual reviews. However, the amount purchased by the central bank between January and December 2024 was significantly higher than the total IMF package. The IMF loan comes at nearly 5% interest in dollar terms, and the country’s economic policies remain subject to the Bretton Woods System organisationsthe World Bank and IMF.